This morning, September nonfarm payrolls soared past expectations, 254,000 vs. 132,500. Adding to the bullishness was the upward revision to August nonfarm payrolls as the prior reading of 142,000 was boosted to 159,000. This is solid news, especially in an environment where the Fed is committed to lowering interest rates. We did see a tick higher in average hourly earnings for both September and August, however, but initially that is being ignored in terms of market reaction. Let’s see how we close today.

Immediate Reactions

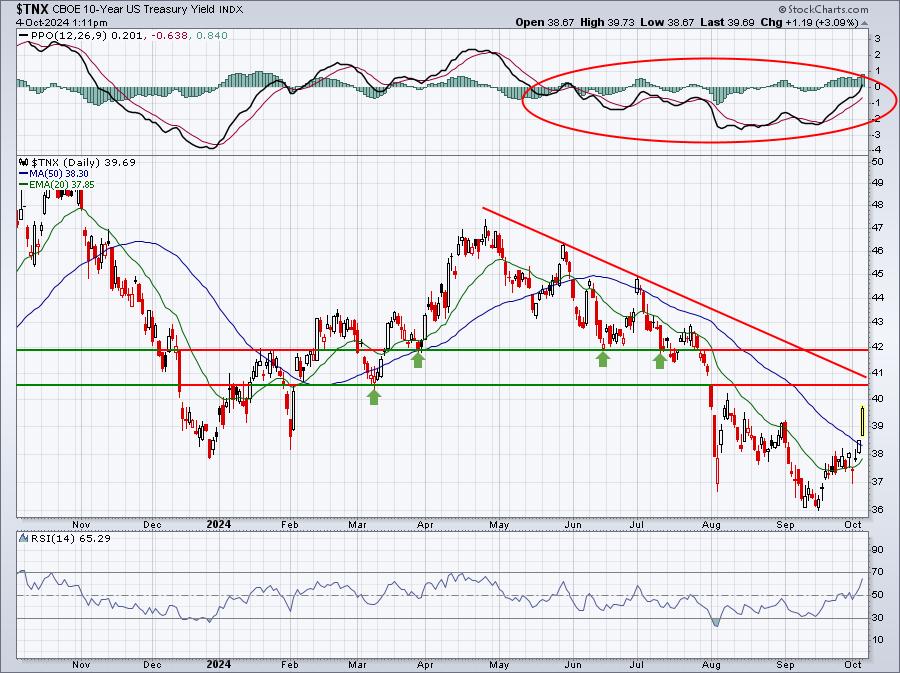

Bonds sold off hard as yields surged. Look no further than the 10-year treasury yield ($TNX), which is higher by 12 basis points, at last check, to 3.97%. I see overhead yield resistance from 4.00% to 4.20%. Remaining below that level keeps the TNX in a downtrend – at least in my opinion:

We still have some room to the upside in the TNX, but as we move higher and higher, don’t the odds begin to turn more in favor of another leg lower?

Next is the U.S. Dollar Index ($USD). Many market participants were worried about the long-term direction of the dollar as the greenback had been downtrending since double-topping in April/May. Here’s the 1-year USD chart:

After the USD moved just beneath support from the late-December 2023 low, it has quickly rallied, and today cleared what appears to be channel line resistance. This could likely reignite the long-term uptrend in the USD:

We know that a rising dollar typically impacts commodities in a negative way, so what should we expect in Q4 and into 2025?

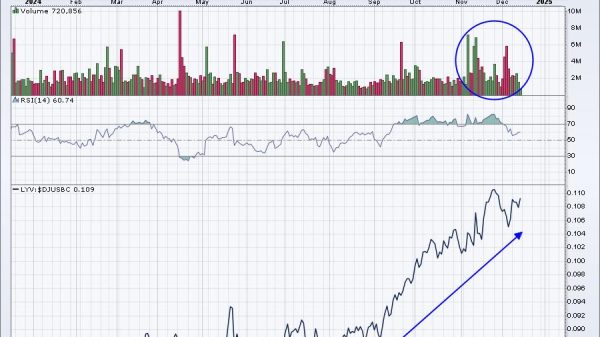

Finally, the initial spike in the TNX has really spooked homebuilder ($DJUSHB, -3.03%) stocks, which have fallen rather harshly today, despite the overall market rally. Personally, I think this is probably a bit overblown, but the group does show a negative divergence on its daily chart, so perhaps a little more selling would set the group up for a long trade:

When a chart shows an uptrend, pullbacks to bring the RSI level down to the 40-50 range generally represent nice buying opportunities. Will this one?

MarketVision Q4 Outlook Event

EarningsBeats.com is hosting our 1st MarketVision mini-series event, “Q4 Outlook” on Saturday, October 5th at 10:00am ET. I’ll be providing my outlook for Q4, reviewing areas like stocks, bonds, commodities, the dollar, sentiment, seasonality, market rotation, etc. It’s open to ALL members of EarningsBeats.com, including FREE 30-day trial members. Previously, MarketVision-related events have required an annual membership to EarningsBeats.com in order to attend. However, we’re offering the event to FREE 30-day trials for this inaugural event. You can CLICK HERE for more information and to register for this event!

You can always register later this weekend and receive a recording of the event.

See you tomorrow morning!

Tom